E-wallets and mobile payment apps have replaced cash and cards in the last few years. People prefer using the payment wallets over debit and credit cards or cash, due to the convenience offered. Customers need not take the risk of carrying cash and card. The e-wallets is a one stop solution for all payment needs. Reports highlight the fact that with the increase in the use of online payment wallets, the revenue of the mobile wallet market worldwide has risen from 450 billion USD to 750 billion USD. This highlights the success of payment wallet apps.

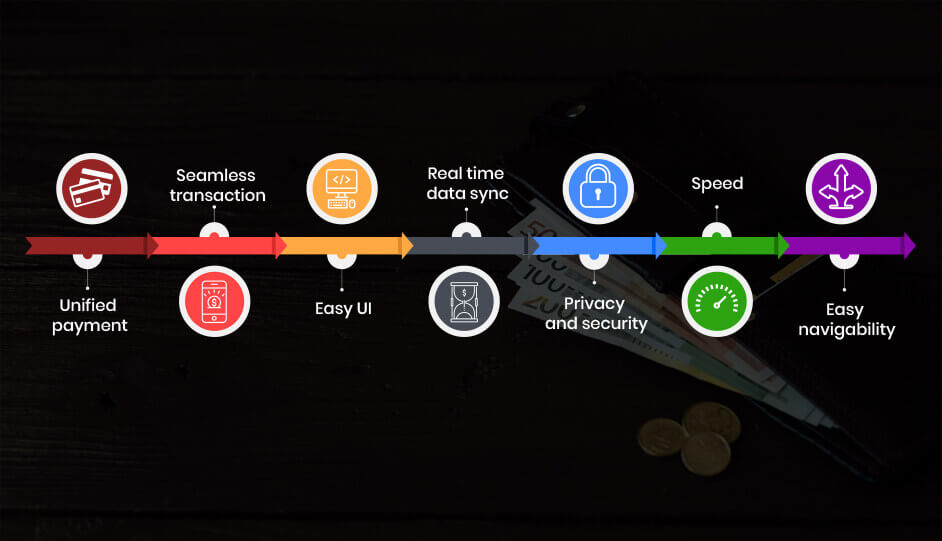

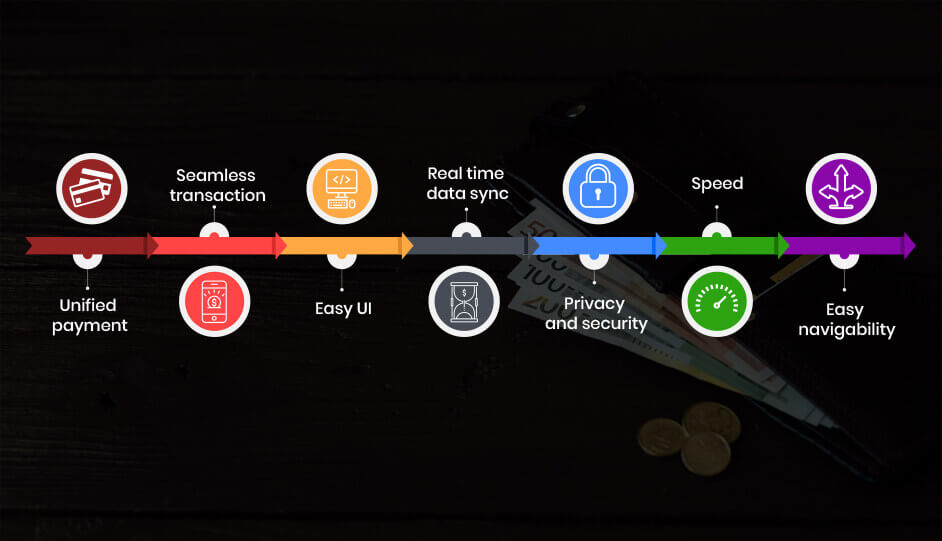

Digital E-Wallet Mobile App Features:

Unified payment

Mobile e-wallets and payment apps offer unified payment options UPI, that helps the users to complete payment, directly from the bank, without the need of recharge to their app wallet.

Seamless transaction

These mobile wallets ensure seamless transactions and offer one-stop payment solution for all financial needs. These wallets and apps are accepted globally and users can complete their transactions seamlessly, with just a few clicks.

Easy UI

The user interface (UI) needs to be user-friendly and easy to use, such that customers can complete their payment easily, without being much tech savvy.

Real-time data sync

The transactions need to sync in real time. Lack of real-time synchronization will result in a discrepancy of account balance remaining after each transaction. Real time sync ensures that after the transactions are successfully completed, the account balance shows the same amount after deduction.

Privacy and security

One of the essential and highlights of an e-wallet or mobile payment app is security and protection of privacy. The transactions need to be secure and the privacy of the users needs to be protected.

Speed

Speed of transactions is essential. The e-wallets and payment apps need to have fast loading time, even with slower Internet connectivity. This makes the app even more versatile.

Easy navigability

Navigability or moving from one screen to the other should be done easily, such that users can do so without having to look for options. The flow in which the users use the app needs to be seamless. The color and font should also be prominent enough to guide the users smoothly.

User’s issues without e-wallets app

1) Using cards and cash is time-consuming

2) Lack of security and fear of theft of cards and cash

3) Refund and cancellation issues are time taking with net banking or card payments

4) No consolidated record of transactions, other than bank statements

Merchant’s issues without e-wallets app

1) Time-consuming as card payments need to be done one at a time

2) Complex process of cancellation or refund to the users

3) Bank statements only for consolidated record keeping

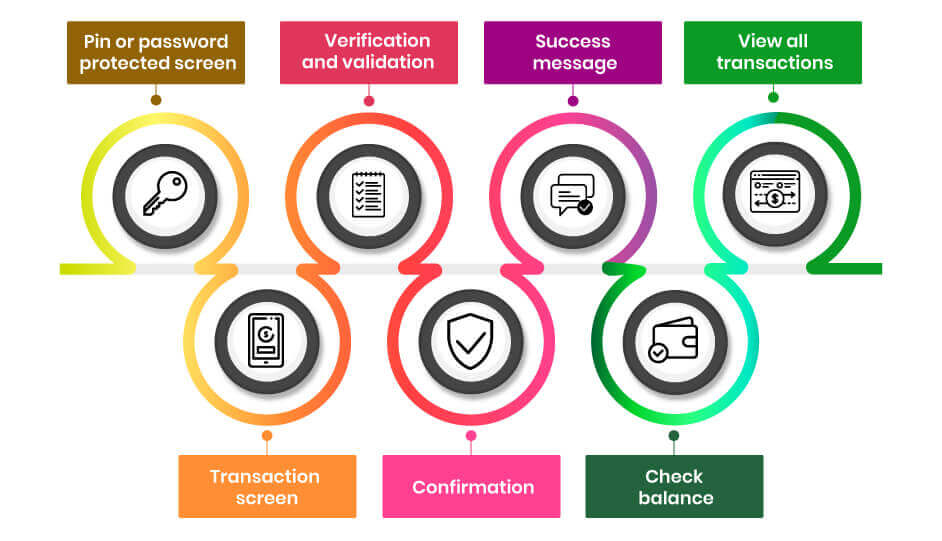

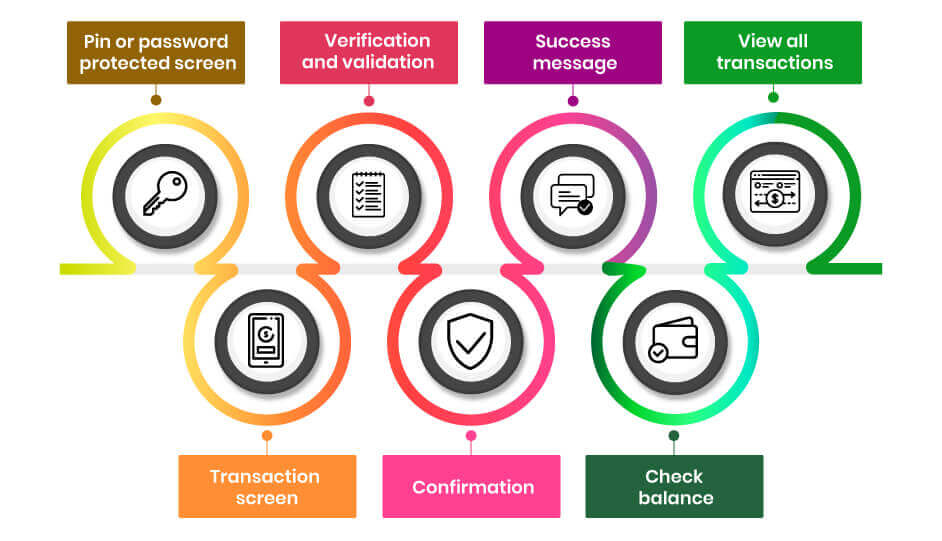

Design of E-wallets and Mobile Payment App:

A basic e-wallet or payment app designs as follows:

Pin or password protected screen

This is the first screen which the users get, after tapping into the app icon. This is usually password or pin protected offer security. Even if the smartphone gets stolen, the thieves will not be able to use this app instantly, until hacked in, to crack the password. This offers the initial layer of security.

Transaction screen

The next screen is the transaction screen, where the users will make the transactions. The users can either scan the QR code of the recipient or enter the recipient's mobile number to transfer money.

Verification and validation

Once the users confirm their recipient's payment details and the amount and confirm it, either an OTP verification or pin is required to proceed with the payment.

Confirmation

After the required Pin or OTP is confirmed, the payment is processed successfully.

Success message

After the payment is successful, the user receives a success message.

Check balance

Users can check their bank account balance, using the e-wallets and payments app. Hence the app should be authorized to access the servers of the bank and retrieve the user’s balance of the bank account linked with the app.

View all transactions

The app should offer features such that the users can see a consolidated record of all the transactions made using the mobile wallet app. This is also an essential feature and should be included in apps like Google Pay and Phonepe.

Read more: How much does it cost to build mobile wallet app like Payand TM

Thus with a technically sound team of developers, along with efficient UI/UX designers, an eWallet app like PhonePe or Google Pay can be built easily. The mobile app development cost ranges from $25k to $50k, depending on the features included and layers of security implemented.

Get the best eWallet and mobile payment app developed by Nextbrain Technologies

Saran

September 15, 2020 Author